Sometimes a price is in congestion and you expect it to move out of its congestion phase but you don’t know in which direction you expect the move to be. In such situations you can setup a one-cancels-others (OCO) conditional order. What you do is that you place two conditional orders: one limit- or stop order is activated when the price moves higher out of the congestion zone and a second limit- or stop order is activated when the price moves down and lower out of the congestion zone. Once one of the two conditional orders is activated it automatically cancels the other conditional order.

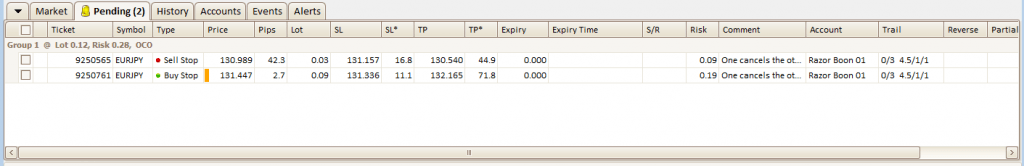

In FX Synergy I created two pending stop-orders and then selected the two and created a group. The title is Group 1. Then select that grey titlebar and right click to add the OCO attribute to the group.

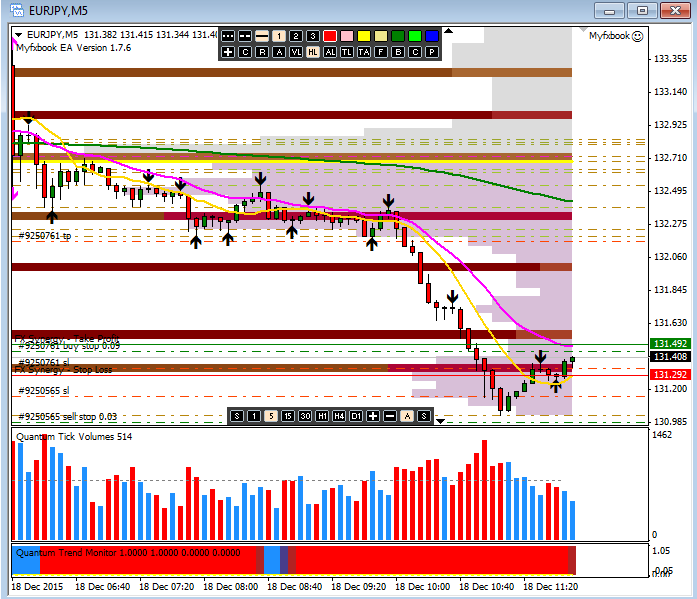

Below is a price chart. To demo it I created a simple and very small order. As you see, the price is just shortly in a congestion zone, but enough to demo the OCO setup. Just above the congestion zone you see a green horizontal line which is the buy stop order and further up the tp (take profit) target associated. Of course, the stop-order also has an associated stop-loss. The same is found below the congestion zone where you can just see the green sell stop line.

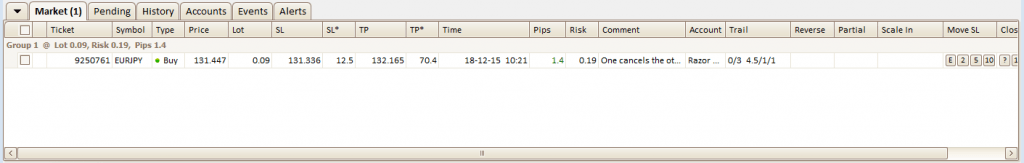

Below you see that there is only one order left and it moved from the pending order tab to the Market order tabs. The price moved up and activated on of the pending orders and thereby canceling on the other pending order.