When you do business with companies abroad and get paid in foreign currencies, you might wander if you can protect the business trade against a drop in exchange rate.

Lets take an example where you do business with a South African firm that pays you in South African Rand (ZAR) for your services. You yourself are based in Europe and have to convert the South African Rand (ZAR) to the Euro (EUR) and might be worried that during the course of your working agreement with your South African partner, the value of the Rand might drop against the Euro.

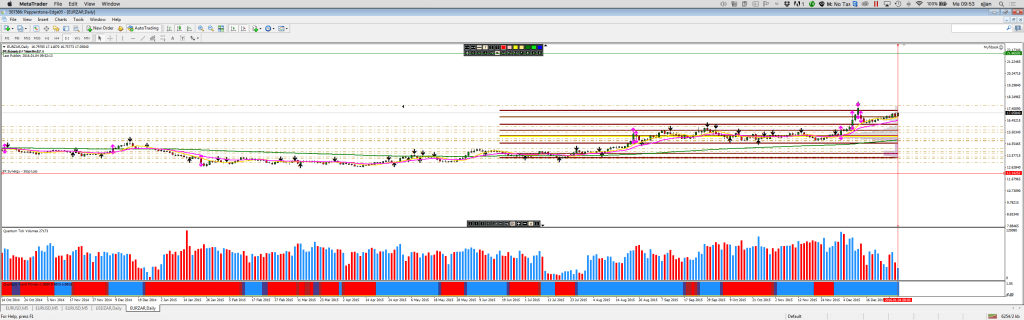

If you look at the EURZAR over the period October 2014 until today (January 4, 2016), then you see that the EURZAR started at 14.2068, dropped down to 12.6505 and climbed up to a value today of 16.9872. In general you see that the base currency (EUR) is gaining in strength over time against its counter currency (ZAR). Since last summer the EURZAR has been in congestion most of the time around a price of 15.1324, but the Rand has weakened again lately against both the USD and EUR at the end of 2015.

The reasons behind a weak Rand are amongst others a run of investors to risk-off markets at the end of the year, where the ZAR is considered a risk currency. Although the financial sector is the biggest contributor to the South African economy, South Africa is still a country that relies heavily on commodity exports. With commodity prices falling due to the slowdown in China, all currencies that are exposed to commodities are being sold off. Finally, South Africa is a country that is struggling to solve its own internal problems which is contributing to further Rand weakness. Although the general sentiment surrounding emerging markets is negative, South Africa is not helping its own sentiment by not solving its internal issues. Electricity shortages and a struggling manufacturing sector have to be addressed if the long-term decline of the Rand is to be turned around. The current political situation is not the best with President Zuma firing a very popular finance minister just lately and plunging the country into a further spiral down scaring off foreign investors. Read this Bloomberg article of December 2015 to get an idea of where South Africa is heading.

Currency Hedging

If you expect the Rand to weaken even more while at the same time you are expected to be paid in South African Rand, you could consider several options to protect against a further decline in value. One way to protect against a further decline in value of the Rand is to invest or shorten in an exchange-traded fund. One such an ETF is the “South African Rand WisdomTree Dreyfus ETF with the symbol SZR on the forex pair ZAR/USD. Another way is to go long or short on the EURZAR or USDZAR currency pair.

Lets assume that we want protection against a further weakening of the Rand against the Euro. In this example I am not considering the bid versus ask price as well as any carry trade or any interest rate differential (IRD). The current EURZAR exchange rate is 16.9820 and I am worried that the Euro might strengthen against the ZAR to an exchange rate of 22.1250.

If I could borrow today 1 million Rand from my broker to convert that instantly into Euro, I would be able to buy 58.885 euro with the 1 million Rand. Then the EURZAR strengthens to 22.1250. I borrowed 1 million Rand, so have to pay that back. If I would exchange the full 58.885 euro into Rand against the new exchange rate of 22.1250, that would give me 1.347.583 rand. Deduct from that the 1 million Rand I borrowed earlier on from my broker and I have 347.583,00 rand left over which would be equal to 15.709,00 euro.

So, the Rand may go down in value, but I had protected myself against it with the above currency transaction on the EURZAR.

What if, however, the value of the Rand would strengthen against the Euro, then this hedge would not work and go against me. One way to limit that loss is to work with a stop-loss at 14.2129. The EURZAR has been in congestion for the past 6 months in a price range in between 14.7172 and 15.9053 until the beginning of December where the EURZAR went to peak at 17.6175. If the EURZAR would weaken and go down, it would then be stopped out and we would loose some but limited money on the way down. On the other hand, I would then at the same time win on the business trade payment in Rand from my South African partner where now the payment in Rand would give me more Euro-money in my hand.

In summary, it does pay off to think ahead. Nobody can look into the future and know for sure what a currency is going to do. Is it strengthening or weakening? You can’t tell for sure, but you can take measures to cover for currency-loss risks. Of course, one thing you can do is agree to be paid in Euro instead of Rand. If that is not an option to you, you can consider the currency hedge option. If you do consider such a strategy, be aware that there are several other ways in which you could hedge the currency risk such as a strategy using futures or forward contracts. However, you could use the spot forex market as the spreads on many currencypairs such as the EURUSD is very narrow and thus the costs low. Also, you can take advantage of leverage. However, you also have to take the interest rate differential / Carry Trade into account.

Further reading:

Hedging Against FX Risk article 2006.

Interest Rate Differential (IRD) definition.

Carry Trade post on Investopedia.