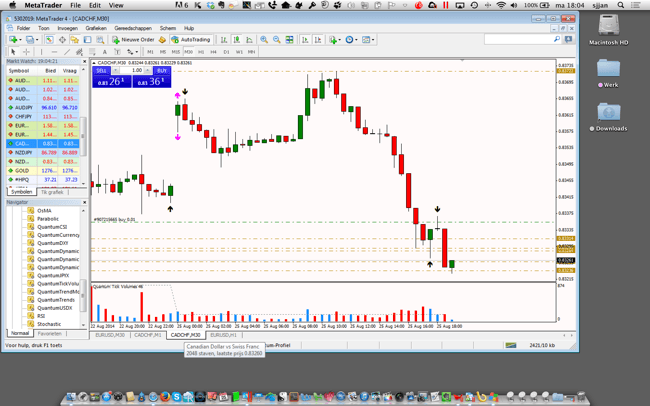

This afternoon I did a test trade on the Canadian Dollar – Swiss Franc (CANCHF) currency pair. I wanted to technically test FX Synergy and to be sure I would not loose too much on this trade I selected to trade a micro-lot. A standard-lot is 100.000 CHF. A mini-lot is 10.000 CHF and a micro-lot is 1000 CHF. The PIP value on a micro-lot on this currency pair is 10 cents per pip. The TP (take-profit) was not set and I took the order out manually with a small loss of around 7 pips, which results in 70 cents loss.

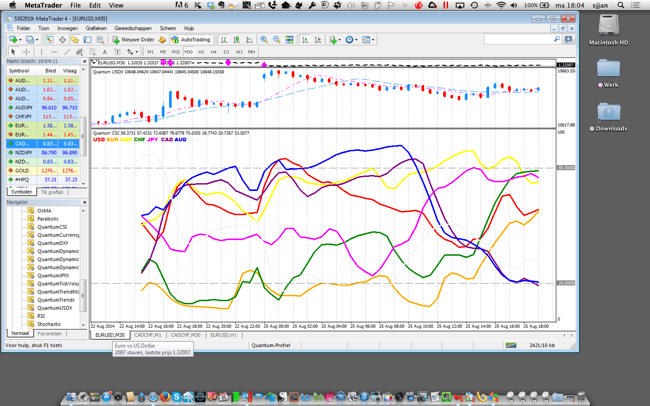

I started out looking first at the Currency Strength Indicator (CSI) as seen in the screenshot above to see which currencies are “overstressed”. I could not find anything of interest for a possible trade setup here, but wanted to do a test trade to test the FX Synergy software with a small lot-size.

After looking at the CSI, I looked at several charts on the CANCHF currencly pair to see which one is the strong currency of the 2 in the pair. Another way to find this information is to look at a Currency Matrix. In the end I opened a very small position using FX Synergy. FX Synergy automatically did set the SL (stop-loss) and can also set the TP (take-profit) for me.

While the order was in the market I took some time to test the adjustment of the order from within FX Synergy such as changing the SL/TP settings and then eventually manually closed the open position. The adjustment of the order in FX Synergy did not go 100% as expected as I got some error messages. I will do some more small micro-lot orders to test FX Synergy a little more.

Robertsaupt says

Все трендовые события часового искусства – новые новинки именитых часовых брендов.

Абсолютно все коллекции часов от дешевых до очень роскошных.

https://watchco.ru/

Stephensex says

Все актуальные события часового мира – трендовые новинки легендарных часовых домов.

Абсолютно все коллекции часов от бюджетных до ультра премиальных.

https://bitwatch.ru/